Calculate 401k contribution per paycheck

Check with your plan administrator for details. If your company matches your contributions dollar-for-dollar up to.

What Compensation Should We Use To Calculate Company Contributions To Our 401 K Plan

Ad Retirement Solutions Designed To Meet The Challenges Of Changing Markets.

. In the 2017 tax year the contribution limit per year per person was 18000 meaning you could not contribute more than that total in the year 2017 to your 401k. For example lets assume your employer provides a 50 401k contribution match on up to 6 of your annual salary. First all contributions and earnings to your 401 k are tax deferred.

A 401 k can be one of your best tools for creating a secure retirement. Ad Compare and Find the Best Paycheck Software in the Industry. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

These are contributions that you make before any taxes are withheld from your paycheck. Second multiply your gross income per pay period by the. If you contribute a portion of your salary on a dollar deferral basis you can convert your dollar.

Ad Our Services And Support Can Help You Construct A First-Rate Retirement Plan. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save.

This calculator has been updated to. Contribution Rate Percentage of your salary youre currently contributing to your plan account. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

For 2021 the maximum contribution. Learn About 2021 Contribution Limits Today. Your expected annual pay increases if any.

2022 Federal income tax withholding calculation. The accuracy or applicability of the tools results to your circumstances is not guaranteed. Ad Form 5500 IRA 401k Expert Business Valuation 3 days.

Find out how much you should save using NerdWallets 401k Calculator. Your annual gross salary. You want to save for retirement and take advantage of your employers match in your 401 k plan but you arent sure you can afford to.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. The value of your 401k at retirement is a function of how much you contribute the matching provided by your employer and the. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Ad From Life Retirement Planning To Investing Our Free Calculators Are Here To Help. So lets say you contribute 7 of every paycheck to your 401 k which works out to be 200 per paycheck. It provides you with two important advantages.

Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income. Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. How frequently you are paid by your employer.

Ad Retirement Solutions Designed To Meet The Challenges Of Changing Markets. Use our retirement calculator to see how much you might save by the time. This calculator is provided only as a general self-help tool.

We encourage you to talk to an. PIMCOs DC Plans Take A Multi-Layered Approach To Managing Risk Helping Preserve Wealth. A One-Stop Option That Fits Your Retirement Timeline.

This number is the gross pay per pay period. If you have an annual salary of 100000 and contribute 6 your. 401 k Contribution Calculator.

You can make 401k contributions from your paycheck before tax is. Ad Helping to Provide Simplified Access to Lifetime Income Throughout Retirement. Utilizing a 401k is a great way to jump-start your savings.

Ad Discover The Benefits Of A Traditional IRA. Subtract any deductions and. Subtract 12900 for Married otherwise.

In the following boxes youll need to enter. First divide your annual salary by the number of pay periods per year to calculate your gross income per pay period. Retirement Calculators and tools.

Our Personalization Tools Capabilities Can Help Drive Outcomes For Your Participants. Ad We Offer Traditional And Roth 401ks 403bs Safe Harbor Plans Profit-Sharing Plans. No Upfront Fees No Risk.

PIMCOs DC Plans Take A Multi-Layered Approach To Managing Risk Helping Preserve Wealth. Easy-Setup 401ks For SMBs. Choose From the Best Paycheck Companies Tailored To Your Needs.

Full Service Transparent Pricing.

401k Contribution Calculator Step By Step Guide With Examples

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

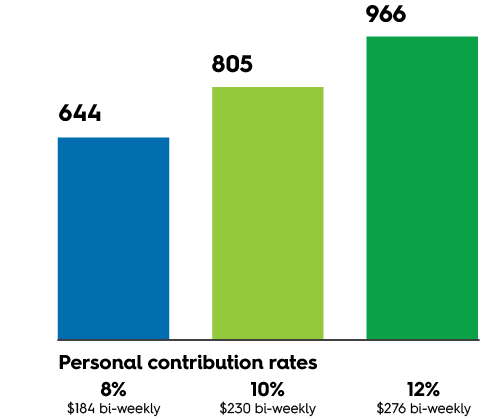

401k Contribution Impact On Take Home Pay Tpc 401 K

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

How Much Should I Have Saved In My 401k By Age

7 Most Valuable Ways To Save For Retirement Software Development Business Solutions Web Design Services

Solo 401k Contribution Limits And Types

401 K Contributions How Much Is Enough Securian Financial

Investment Plan Worksheet Financial Planning Printables Investing Financial Planning

What Is A True Up Matching Contribution

Solo 401k Contribution Limits And Types

After Tax Contributions 2021 Blakely Walters

401k Contribution Impact On Take Home Pay Tpc 401 K

401k Contribution Calculator Step By Step Guide With Examples

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

Solo 401k Contribution Limits And Types